Best Invoice Software for Small Businesses

Fundera

MARCH 7, 2020

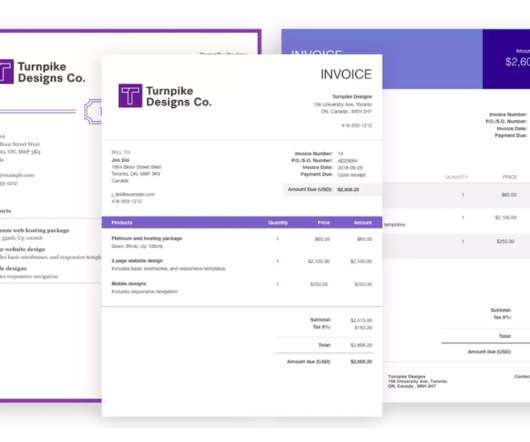

10 Best Invoicing Software Solutions. FreshBooks : Best overall invoice software. Wave : Best free invoicing software. Invoice Ninja : Best open-source invoicing software. Due : Best invoice software for low-fee payment processing. Invoice2Go : Best mobile invoicing software. Bill.com : Best invoice software for automated bookkeeping. Zoho Invoice : Best invoicing software for scalability.

Let's personalize your content