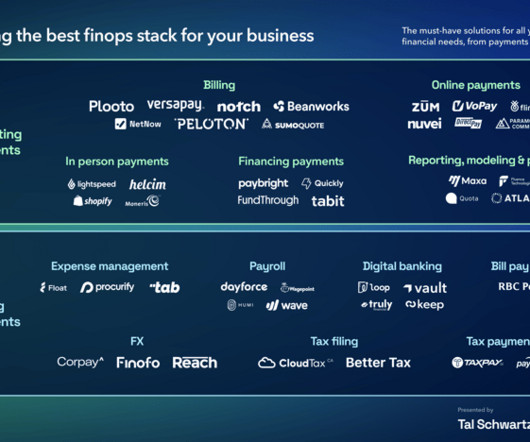

Mapping the best finops stack for your business

Plooto

JULY 11, 2024

Financial technology (fintech) makes it easier for businesses to do everything from issuing invoices and processing payments to managing expenses and making payroll. These solutions are the behind-the-scenes tools that quite literally allow businesses to send and receive money.

Let's personalize your content