How Business Credit Reports Work

CreditStrong for Business

AUGUST 23, 2024

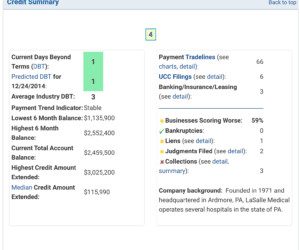

The Major Business Credit Reporting Agencies The job of a business credit reporting agency (also called a business credit bureau) is to gather information about your company. A credit bureau gathers details from your previous creditors and other sources and puts that data into a business credit file.

Let's personalize your content