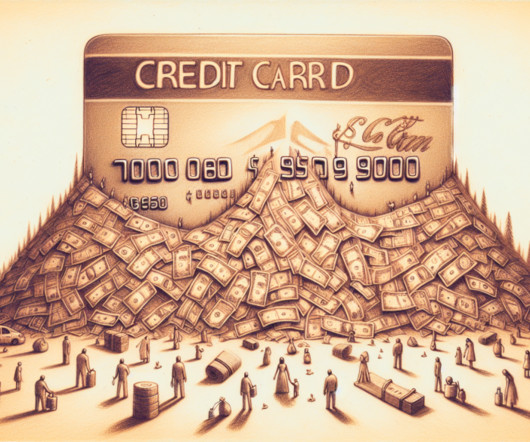

Online Credit Reports & How They Are Tracking Everything You Do

Due

JANUARY 3, 2023

Additionally, consumer reporting agencies can convince landlords, employers, banks, and insurance companies that their dossiers are necessary. In the version of the credit report you receive, your spouse’s name may appear, but not in the version shared with others. Mistakes Caused by Big Data are Bigger.

Let's personalize your content