Top 10 Strategies for Reducing Days Sales Outstanding (DSO)

Your Virtual Credit Manager

JANUARY 7, 2025

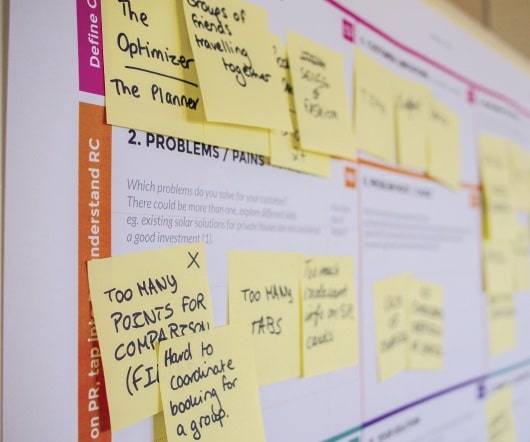

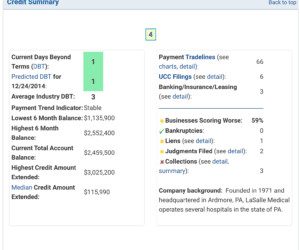

Accelerating sales can increase DSO, but most often the cause is problems in the order-to-cash (O2C) pipeline affecting collections. Your Virtual Credit Manager is a reader-supported publication. Learn More About Credit Reports Please share this newsletter with your small business customers. Need help improving cash flow?

Let's personalize your content