Supercharge Your Collections

Your Virtual Credit Manager

SEPTEMBER 17, 2024

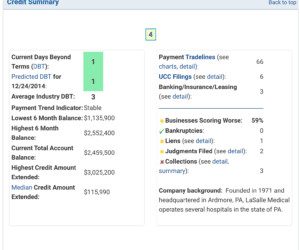

For small business executives, and many mid-sized businesses as well, managing collections effectively can be a significant challenge, particularly when time and resources are limited. To improve your collection efforts, you need to first see what is under the hood. Do you need help assessing your customers’ credit risks?

Let's personalize your content