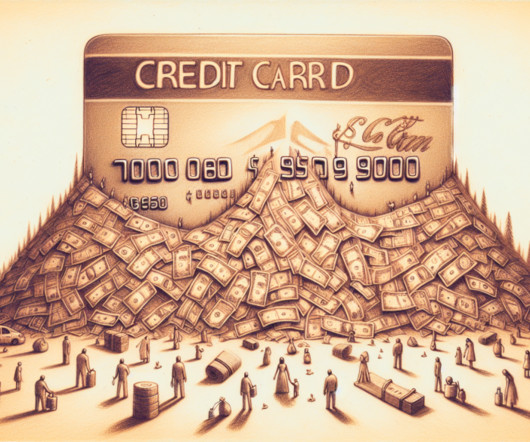

Online Credit Reports & How They Are Tracking Everything You Do

Due

JANUARY 3, 2023

You might get asked similar questions by lenders when you apply for loans and credit cards. To find out, they might check your credit report. What are credit reports, why are they important and what is in them? What is a Credit Report and Why is it Important? Credit Reports vs. Credit Scores.

Let's personalize your content