Incora’s 2022 Uptier Transaction Takes Center Stage in Wesco Chapter 11

Reorg Blog

JUNE 5, 2023

Incora's 2022 uptier transaction will take center stage in Wesco Aircraft's chapter 11 cases. Read more from Reorg.

Reorg Blog

JUNE 5, 2023

Incora's 2022 uptier transaction will take center stage in Wesco Aircraft's chapter 11 cases. Read more from Reorg.

Trade Credit & Liquidity Management

APRIL 2, 2025

Chapter 11 Plans Fail the Majority of Time, Increasing Costs for Lenders There are many times that a defaulting borrower believes in his/her mission and wants another chance to survive, emerge and succeed once again. At face value, Chapter 11 would seem to present a viable option, but the statistics tell a different story.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Lendio

MAY 23, 2023

Throughout this guide, we will break down complex accounting concepts and give you step-by-step instructions for entering common transactions. At its most basic, bookkeeping consists of the recording all financial transactions—such as sales, purchases, payments, and receipts—in a structured manner. What Is Bookkeeping?

Lendio

JULY 31, 2023

Small business accounting is the process by which a small business records its financial transactions and presents them in a standard format known as financial statements. And most accounting software is “smart”—it starts learning how to automatically categorize certain transactions, gradually lessening the time burden for you.

Fundera

MAY 22, 2018

There are three options when filing for business bankruptcy: chapter 11, 7, or 13. Which chapter of business bankruptcy you file for depends on your ownership structure, and what you want to happen to your business afterward. But, in reality, the negatives of merchant cash advances can far outweigh the positives.

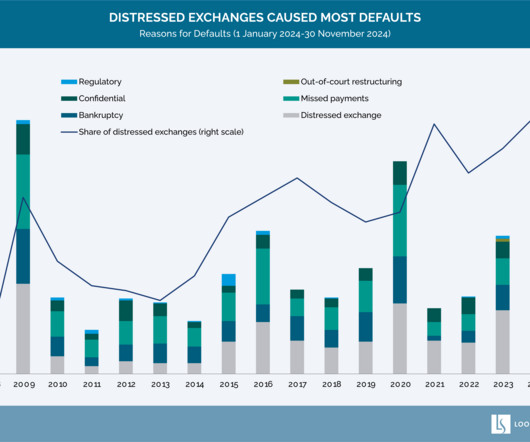

Loomis Sayles Credit Research

JANUARY 13, 2025

LMEs, also known as distressed exchanges, involve renegotiating debt terms outside of bankruptcy, often allowing companies to stabilize their balance sheets inorganically and avoid a Chapter 11 filing at an inopportune time, such as when earnings are at a cyclical low.

Let's personalize your content