The 8 Best Places to To Stash Your Retirement Savings

Due

FEBRUARY 15, 2023

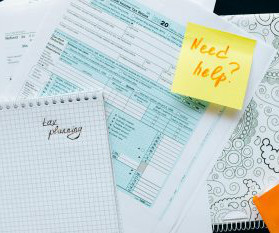

Like investments in taxable brokerage accounts, retirement account funds can be invested. Also, because Roth IRA investments are funded with after-tax dollars , they are not deductible,” he adds. Withdrawals, however, are deductible. In the first place, you’ll be able to deduct your contributions from your taxes.

Let's personalize your content