How To Clean Up Your Credit Score—5 Straightforward Steps

CreditStrong for Business

FEBRUARY 25, 2025

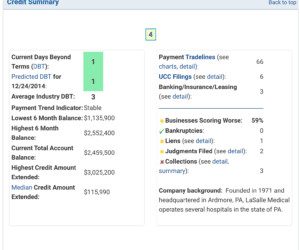

The negative remarks that have the most impact on your score include: Accounts in collections or written off as uncollectible Bankruptcy, foreclosures, and repossessions Late payments or delinquency Multiple hard inquiries Note which bureaus report includes the error or derogatory remark so you can handle each with the respective institution.

Let's personalize your content