How Long Does Bankruptcy Stay On Your Credit Report?

CreditStrong for Business

SEPTEMBER 4, 2024

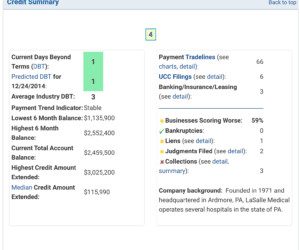

Making the decision to file for bankruptcy is far from easy. The trade-off for having your debt eliminated is a long-lasting derogatory mark on your credit report identifying you as a huge credit risk. Your credit report sees the effects of a bankruptcy filing for ten years for a chapter 7 bankruptcy.

Let's personalize your content