Is Your O2C Process Optimized for Superior AR Performance?

Your Virtual Credit Manager

SEPTEMBER 10, 2024

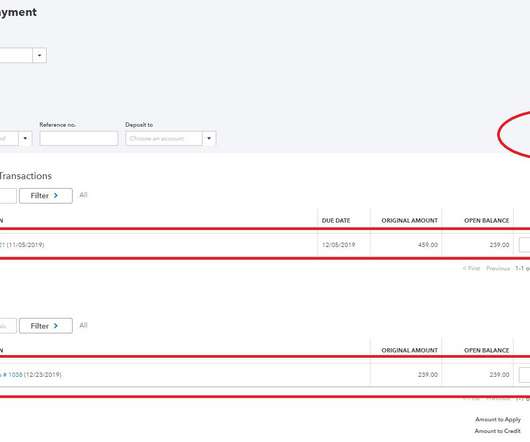

High Deduction Volumes: Consumer goods manufacturers and distributors, and in particular those selling to chain stores, often incur high volumes of payment deductions. Investigating and resolving deductions alone is much too costly. How much time is dedicated to collections versus payment deduction/dispute resolution?

Let's personalize your content