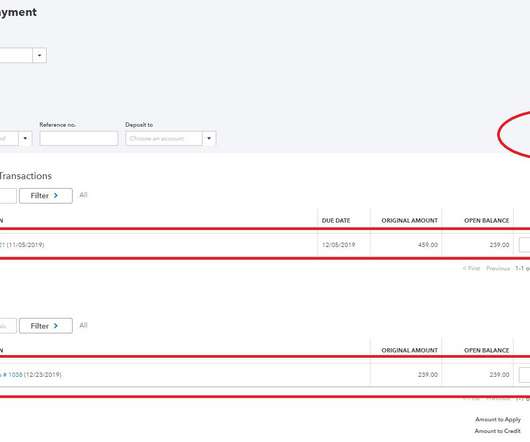

Are You In Control of Your Receivables?

Your Virtual Credit Manager

OCTOBER 17, 2023

Not being paid in full or in part causes a bad debt loss. The first step is to estimate how much bad debt loss you can absorb as a percentage of sales in a year. Conversely, if the profit margin is low, bad debt losses will have a much greater impact, and credit controls will have to be tighter.

Let's personalize your content