Moving Beyond DSO

Your Virtual Credit Manager

FEBRUARY 20, 2024

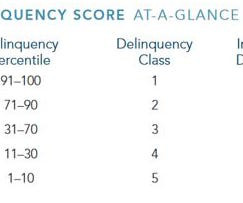

The experts at Your Virtual Credit Manager are ready to help you improve cash flow and reduce AR risks during these challenging times. Learn More About YVCM Consulting The Limitations of DSO Days Sales Outstanding (DSO) is widely used to assess the efficiency of a company's AR management.

Let's personalize your content