Here Are the Distress Signals Private Firms Flash When They Are in Trouble

Your Virtual Credit Manager

APRIL 8, 2025

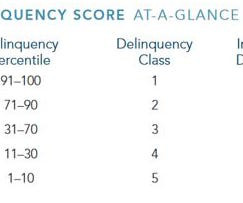

Courts , commercial bankruptcy filings increased 40.3% “The record-high bankruptcy filings in 2024, despite a relatively stable economic environment, suggest systemic vulnerabilities in the business landscape. Customer defaults can be devastating , especially if they cause a substantial bad debt loss.

Let's personalize your content