Red Flags, Slow Payments, and Collection Secrets

Your Virtual Credit Manager

DECEMBER 26, 2023

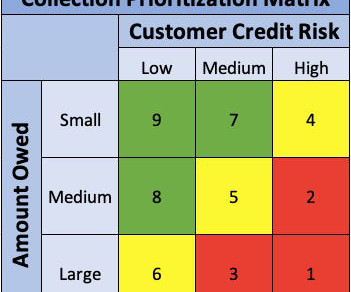

In our case, we found our readers had an affinity for articles on identifying collection risks and the best ways of dealing with past due balances. Photo by Kelly Sikkema on Unsplash ) We are therefore providing you with an overview of three very popular articles along with links to the originals.

Let's personalize your content