Gleaning Actionable Insights from Credit Scores

Your Virtual Credit Manager

APRIL 2, 2024

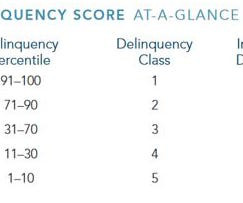

In addition, there isn’t much uniformity from one commercial credit score to the next, and they are designed to predict a range of events. Still others may be predictive of default, financial distress or financial health, and creditworthiness. delinquency or default) than will be found in a random sample.

Let's personalize your content