Evidence It's Time to Adjust Your Collection Practices

Your Virtual Credit Manager

AUGUST 29, 2023

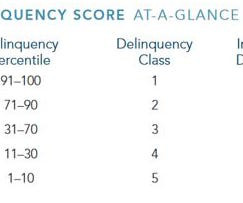

The point is, if DSO is rising, you need to check to determine if collections are the problem. Receivables Are Getting Older: Your AR aging report categorizes outstanding invoices by their age. If a significant portion of your receivables are in the "overdue" categories (e.g.,

Let's personalize your content