Moving Beyond DSO

Your Virtual Credit Manager

FEBRUARY 20, 2024

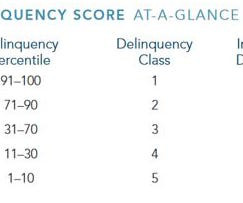

(Photo by Carlos Muza on Unsplash ) A Framework for Choosing Suitable AR Metrics Businesses should carefully assess their specific needs, objectives, and operating context when selecting metrics for accounts receivable (AR) performance measurement. Like any metric, DSO has limitations. Where do you need to improve?

Let's personalize your content