Are Your Collection Efforts Getting the Priority They Deserve?

Your Virtual Credit Manager

SEPTEMBER 3, 2024

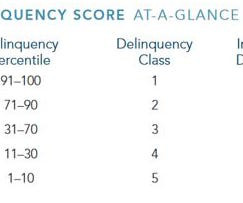

As businesses grow and add customers, there comes a point when collections become a burden. This will generally occur before a company reaches 100 customers on open account, but certainly before they acquire 200 customers. This is a simple matter of efficiency aimed at collecting the most possible dollars with a minimum of effort.

Let's personalize your content