Storm Warning: Private Company Red Flags

Your Virtual Credit Manager

JANUARY 14, 2025

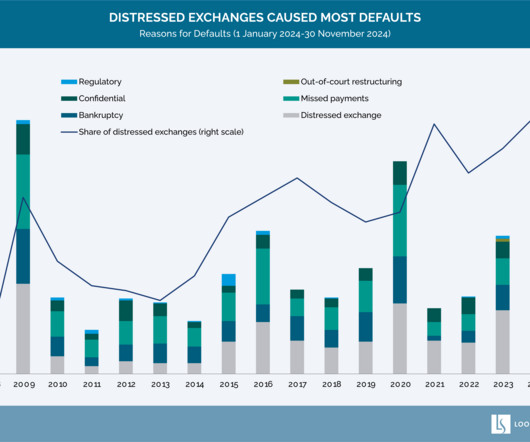

The United States has witnessed a significant surge in corporate bankruptcies, reaching a 14-year high in 2024. Business bankruptcy filings increased by 33.5% during the 12-month period ending September 30, 2024. This trend has been driven by a combination of factors, including rising interest rates, persistent inflation, higher labor costs, and shifts in consumer spending patterns following the pandemic.

Let's personalize your content