Account Team Member Integration – SAP Sales Cloud (C4C) to SAP Marketing Cloud (SMC)

SAP Credit Management

AUGUST 17, 2023

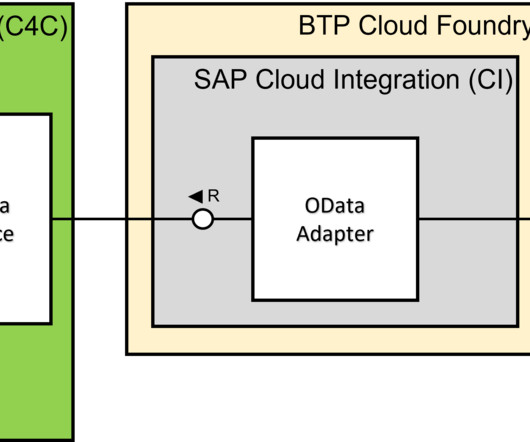

With release 2308, the feature “ Segmentation Attributes for Account Team Members” ( Interaction Contact Attributes | SAP Help Portal ) will be available in SMC. Mapping In the iFlow, the mapping of the C4C OData service to the SMC service needs to be maintained. Following fields need to be mapped.

Let's personalize your content